Paymentsense backend - B2B Backend

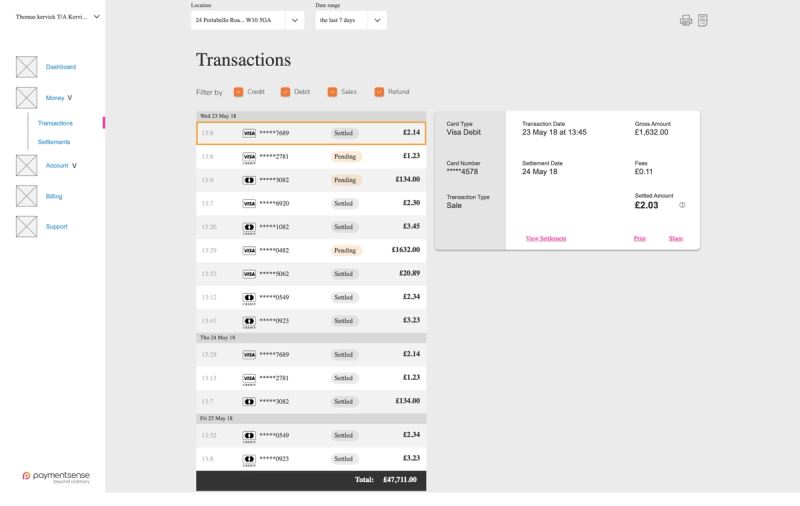

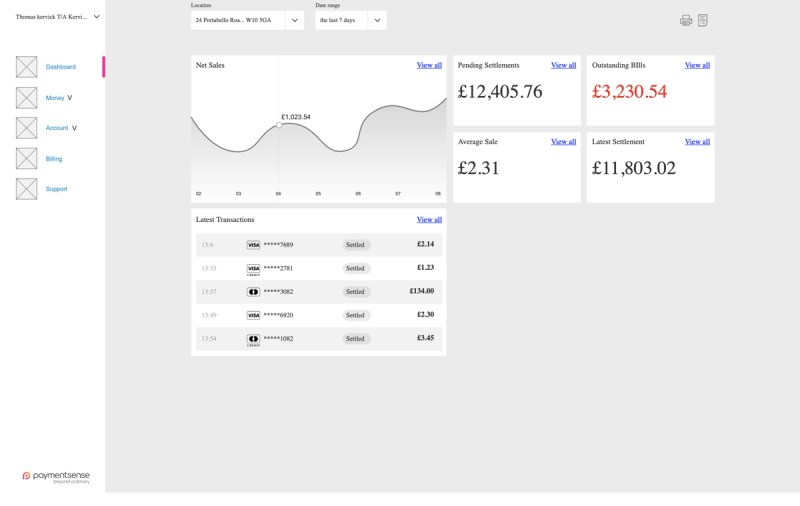

I joined Paymentsense with the exciting opportunity to design their inaugural client-facing management system. This project represented a significant shift in customer interaction for the company. Prior to this initiative, customers had a rather limited experience, primarily receiving passive transaction reports and relying on phone calls with the sales team for any inquiries or issues. The task at hand was both challenging and multifaceted, requiring a deep dive into the intricate world of financial transactions and customer service.

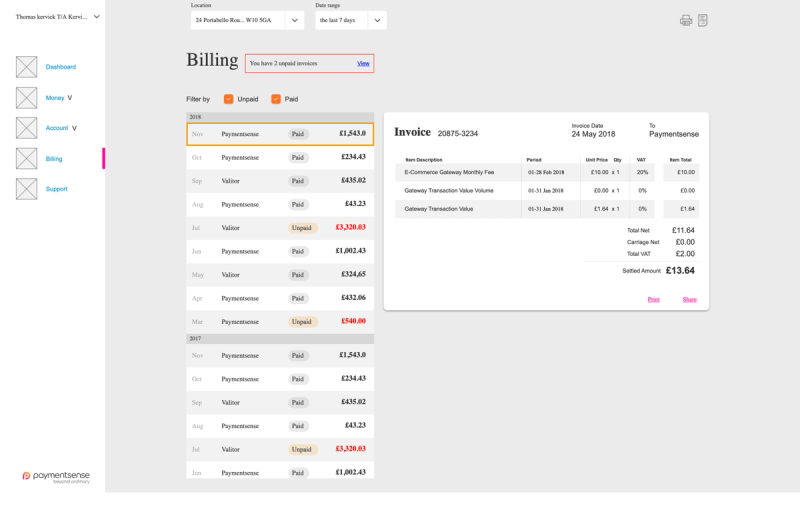

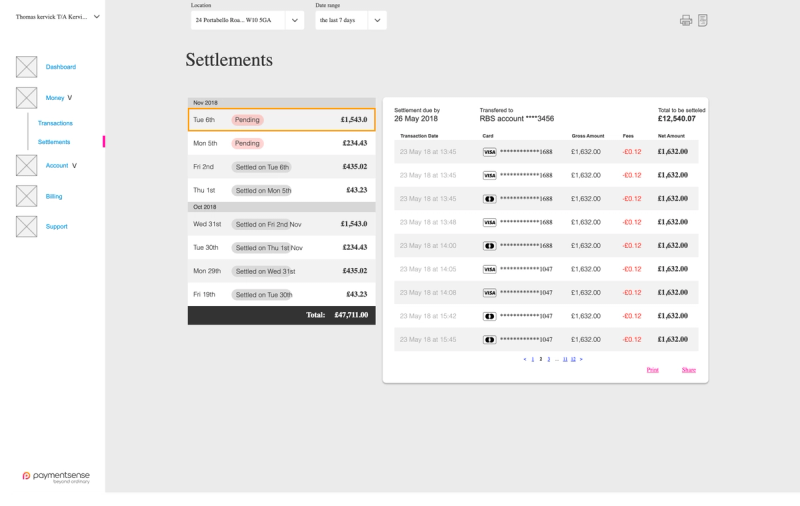

The core challenge lay in deciphering and translating the complex behind-the-scenes business processes that involved multiple stakeholders: banks, payment terminal leasing companies, and Paymentsense itself. Each of these entities played a crucial role in the transaction ecosystem, and understanding their interplay was vital to creating an effective management system. However, the challenge extended beyond mere comprehension; it necessitated a delicate balance between transparency and information overload. The goal was to provide customers with truly valuable, actionable information without overwhelming them with unnecessary technical details.

To successfully navigate this complex landscape and create a user-centric system, I needed to focus on two primary objectives:

- Unravel the Business Logic: This involved a comprehensive mapping of the intricate interactions between banks, leasing companies, and Paymentsense that facilitated transactions. It required in-depth discussions with various departments, analysis of existing processes, and creation of detailed workflow diagrams to visualize the entire transaction lifecycle. Understanding this complex web of interactions was crucial in determining what information would be most relevant and useful for customers to access through the new management system.

- Focus on Customer Needs: With a clear understanding of the backend processes, the next step was to prioritize information that would be most relevant and actionable for customers. This involved conducting user research, creating personas, and mapping customer journeys to identify pain points and opportunities for improvement. The goal was to maintain an appropriate level of transparency while ensuring that the information presented was digestible, meaningful, and empowering for the end-users. This required careful curation of data and thoughtful design of user interfaces to present complex information in an accessible manner.

Through this meticulous process of understanding, analysis, and design, I was able to create a system that fundamentally transformed the way customers interacted with Paymentsense. The new client-facing management system empowered customers to take control of their accounts, access relevant information at their fingertips, and manage their financial transactions more effectively than ever before. This resulted in a significant reduction in the need for phone calls to the sales team, as customers could now self-serve many of their informational and management needs. The system not only improved customer satisfaction but also increased operational efficiency for Paymentsense, marking a significant milestone in the company's customer service evolution.